The Importance of Home Inspections in Real Estate Transactions

What Is a Home Inspection in Real Estate?

A home inspection is a thorough assessment of a property's condition conducted by a licensed inspector. It involves evaluating various aspects of the home, including structural elements, electrical systems, plumbing, HVAC systems, and more. The goal is to identify any existing or potential issues that could affect the property's safety, functionality, or value.

In real estate transactions, a home inspection is typically performed after a buyer makes an offer on a property but before the sale is finalized. The findings from the inspection can influence negotiations, allowing buyers to request repairs or adjust their offer based on the property's condition.

Why Home Inspections Are Crucial in Real Estate Transactions in illinois

Home inspections are crucial for several reasons:

- Risk Mitigation: They help identify hidden issues that could lead to costly repairs down the line.

- Negotiation Tool: Buyers can use the inspection report to negotiate repairs or a lower purchase price.

- Peace of Mind: Both parties can proceed with the transaction knowing the property's true condition.

4. Legal Protection: For buyers, a thorough inspection can prevent legal disputes over undisclosed property issues.

Key Areas Covered During a Home Inspection in illinois

A comprehensive home inspection typically covers the following areas:

- Roof and Exterior: Checking for leaks, missing shingles, and exterior damage.

- Foundation and Structure: Looking for cracks, shifting, or water damage.

- Plumbing System: Ensuring pipes, drains, and water heaters are functioning properly.

- Electrical System: Verifying the safety of wiring, outlets, and circuit breakers.

- HVAC System: Inspecting heating, ventilation, and air conditioning units.

- Interior: Examining walls, ceilings, floors, windows, and doors.

- Attic and Basement: Checking insulation, ventilation, and potential moisture issues.

Benefits of Home Inspections for Buyers

For buyers, home inspections provide several advantages:

- Uncover Hidden Problems: Identifies potential safety hazards or costly repairs.

- Negotiation Leverage: Allows buyers to request repairs or adjust the purchase price.

- Informed Decision-Making: Helps buyers decide whether to proceed with the transaction.

- Future Planning: Provides insight into necessary future maintenance and repairs.

Benefits of Home Inspections for Sellers

Sellers can also benefit from home inspections in the following ways:

- Preemptive Repairs: Address issues before listing to improve the home's appeal.

- Faster Transactions: Reduces the likelihood of surprises that could delay closing.

- Increased Buyer Confidence: A clean inspection report builds trust with potential buyers.

- Fair Pricing: Justifies the asking price based on the property's condition.

How Home Inspections Impact Property Value in illinois

A home inspection can significantly impact a property's value. If serious issues are found, buyers may request repairs or a reduction in price. Conversely, a clean inspection report can boost the property's value and appeal.

For sellers, addressing issues before listing the property can lead to a higher sale price and faster closing. Buyers, on the other hand, can use the inspection report to ensure they are making a sound investment.

Common Issues Found During Home Inspections in illinois

Some of the most common issues uncovered during home inspections include:

- Roof Damage: Missing or damaged shingles, leaks, or poor drainage.

- Plumbing Problems: Leaky pipes, outdated fixtures, or water heater issues.

- Electrical Issues: Faulty wiring, outdated systems, or overloaded circuits.

- Foundation Cracks: Structural problems that could lead to costly repairs.

- HVAC Problems: Malfunctioning heating or cooling systems.

- Mold and Moisture: Signs of water damage or mold growth.

Home Inspection vs. Appraisal: What's the Difference?

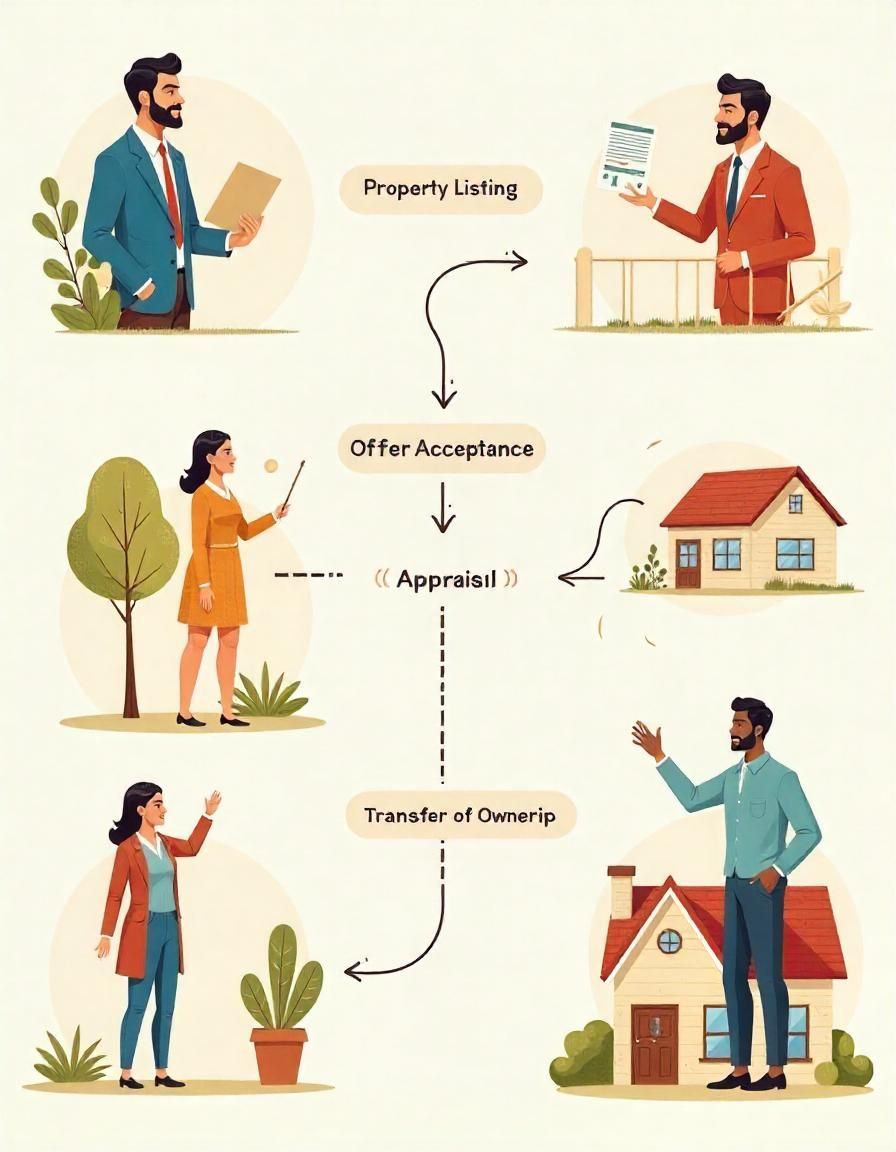

While both home inspections and appraisals are essential in real estate transactions, they serve different purposes:

- Home Inspection: Focuses on the property's condition and identifies potential issues.

- Appraisal: Determines the property's market value based on factors like location, size, and comparable sales.

An appraisal is required by lenders to ensure the property's value matches the loan amount. In contrast, a home inspection is more detailed and focuses on the physical aspects of the property.

Choosing the Right Home Inspector in illinois

Selecting a qualified home inspector is crucial for a thorough and reliable assessment. Here are some tips for choosing the right inspector:

- Check Credentials: Ensure the inspector is licensed and certified.

- Ask for References: Speak with past clients to gauge their experience.

- Review Sample Reports: Look at sample inspection reports to understand the inspector's thoroughness.

- Ask About Experience: Choose an inspector with experience in the type of property you're buying.

What Happens After a Home Inspection?

Once the home inspection is complete, the inspector provides a detailed report outlining the property's condition. Here's what happens next:

- Review the Report: The buyer reviews the inspection report to understand the property's condition.

- Negotiate Repairs: The buyer may request repairs or a price reduction based on the findings.

- Make an Informed Decision: The buyer decides whether to proceed with the transaction, renegotiate, or walk away.

- Schedule a Reinspection: If repairs are made, a reinspection can ensure the issues were properly addressed.

A Real Estate Transaction Flow Chart

At

Kouklakis Law, we understand that home inspections are a critical part of any real estate transaction. Whether you are buying or selling a property, having legal guidance ensures a smooth process from start to finish. Contact us today to learn more about how we can help you navigate your real estate transaction with confidence.

Hire

real estate transactions lawyer in illinois

Home inspections provide invaluable insights that can protect both buyers and sellers in real estate transactions. They help identify potential issues, offer negotiation leverage, and ensure transparency in the sale process. Working with experienced professionals like

Kouklakis Law can further safeguard your interests and ensure a seamless real estate transaction.

FAQs related to Home Inspection in Real Estate

1. What is a home inspection in real estate?

A home inspection is a comprehensive assessment of a property's condition, performed by a licensed inspector. It covers areas like roofing, plumbing, electrical systems, and structural components to identify potential issues before a real estate transaction is finalized.

2. Why is a home inspection important in a real estate transaction?

Home inspections help uncover hidden problems that may affect a property's safety, functionality, and value. They provide buyers with negotiation leverage and peace of mind, while helping sellers address issues upfront to avoid delays.

3. What are the most common issues found during a home inspection?

Common issues include:\n

- Roof damage\n

- Plumbing leaks\n

- Electrical problems\n

- Foundation cracks\n

- Mold and moisture\n

- HVAC system malfunctions

4. How does a home inspection impact property value?

A home inspection can influence a property's value by identifying issues that require repair. If significant problems are found, buyers may request a price reduction or repairs before closing the deal.

5. Who pays for the home inspection in a real estate transaction?

Typically, the buyer is responsible for arranging and paying for the home inspection. However, sellers can also conduct pre-listing inspections to address issues before putting the property on the market.

6. How long does a home inspection take?

A standard home inspection usually takes 2 to 4 hours, depending on the property's size and condition. Larger or older homes may take longer to inspect thoroughly.

7. Can a buyer back out of a deal after a home inspection?

Yes, buyers can back out of a deal if the inspection reveals significant issues that the seller is unwilling to address or negotiate. The inspection contingency in a purchase agreement allows buyers to withdraw from the transaction without penalties.

8. What is the difference between a home inspection and an appraisal?

A home inspection focuses on the property's condition and identifies potential issues. An appraisal determines the property's market value based on factors like location, size, and comparable sales. Lenders typically require appraisals, but inspections are optional.

9. How should I choose a home inspector?

When choosing a home inspector, consider:\n

- Their licensing and certifications\n

- Experience in inspecting similar properties\n

- References from past clients\n

- Sample reports to gauge thoroughness

10. What happens if a home inspection report reveals major issues?

If a home inspection reveals major issues, buyers can:\n

- Request repairs from the seller\n

- Negotiate a price reduction to cover repair costs\n

Withdraw from the transaction if the issues are too severe

Ready to work with Kouklakis Law?

Let's connect! We’re here to help.

Send us a message and we’ll be in touch.

Or give us a call today at 219-444-3460

Agency Contact Form

More Marketing Tips, Tricks & Tools